In the realm of investment analysis, few metrics hold as much significance as the Price-to-Earnings (P/E) Ratio. This fundamental tool provides a window into a company’s valuation, aiding investors in making informed decisions. Let’s unravel the intricacies of the P/E Ratio and explore why it stands as a beacon for savvy investors.

Decoding the P/E Ratio

Defining the Metric:

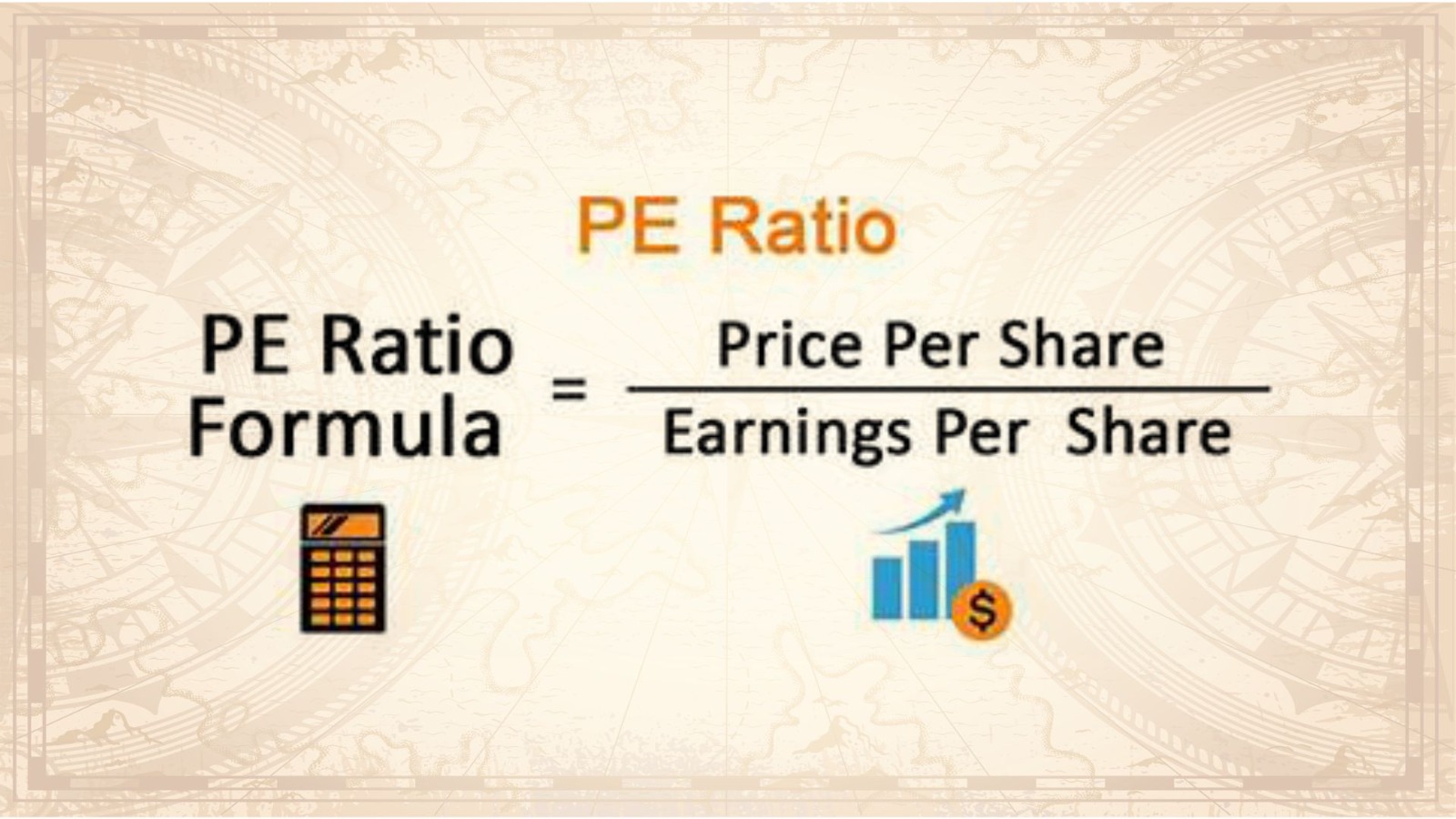

The P/E Ratio is a financial metric calculated by dividing a company’s current stock price by its earnings per share (EPS) over the past 12 months. This ratio is a cornerstone of fundamental analysis, offering insights into how the market values a company relative to its earnings.

Formula:

P/E Ratio

=

Market Price per Share

Earnings per Share (EPS)

P/E Ratio=

Earnings per Share (EPS)

Market Price per Share

The Significance

- Valuation Benchmark:

High P/E: A high P/E Ratio may indicate that investors have high expectations for future earnings growth. It can suggest an optimistic outlook but might also mean the stock is relatively expensive.

Low P/E: Conversely, a low P/E Ratio could imply undervaluation or a more conservative market outlook. However, it might also signal concerns about the company’s growth prospects.

- Growth vs. Value Investing:

Growth Stocks: Investors seeking companies with high growth potential often gravitate towards higher P/E Ratios, as they reflect expectations for robust future earnings.

Value Stocks: Value investors, on the other hand, might favor stocks with lower P/E Ratios, indicating potential bargains and a margin of safety.

- Industry Comparisons:

P/E Ratios vary across industries due to distinct growth rates and risk profiles. It’s crucial to compare a company’s P/E Ratio to its industry peers for a meaningful assessment of its valuation.

Interpreting the P/E Ratio

- Forward vs. Trailing P/E:

Trailing P/E: Based on historical earnings, offering a retrospective view of the company’s performance.

Forward P/E: Based on future earnings estimates, providing insight into market expectations.

- Market Sentiment:

Overvaluation: A significantly high P/E Ratio might suggest overvaluation, prompting investors to assess the sustainability of the company’s growth.

Undervaluation: Conversely, a low P/E Ratio may indicate potential undervaluation, prompting further investigation into the reasons behind the market sentiment.

- Risk Considerations:

Volatility: Stocks with higher P/E Ratios can be more susceptible to market volatility, as any deviation from expected earnings growth can impact valuation.

Stability: Lower P/E Ratios might offer more stability, but investors should ensure it doesn’t signal fundamental issues within the company.

Conclusion

In the intricate dance of financial markets, the P/E Ratio emerges as a guiding light for investors, providing valuable insights into a company’s valuation. Whether deciphering growth potential, assessing market sentiment, or comparing across industries, understanding the P/E Ratio is indispensable for making well-informed investment decisions. As investors navigate the complex landscape of stocks, the P/E Ratio stands as a reliable compass, helping them unlock the secrets of stock valuation and pave the way to sound investment strategies.

So, phlagologin. Logins are easy and quick, no issues there. Site is pretty straightforward too. Recommended, good experience!

Just tried sz777jiliapp and I’m impressed. Everything loaded quickly, and found what I needed without any hassle. Check it out for yourself: sz777jiliapp

Yo, looking for a solid agent? Agent Bong88 seems like a good place to start. Check ’em out for yourself! agent bong88

Downloaded the sv66apps a few days back and I like it! Much easier to play on my phone. Pretty smooth too. Give it a try at sv66apps. May your odds be forever in your favour.