Sula’s Wine Wonderland: Crafting Memories, Breaking Records, and Pouring Happiness

In the midst of this enotourism surge, Sula Vineyards emerges as a front runner, boasting the highest market share in premium wines in India at close to 60%. With over 340,000 visitors, Sula stands as the most visited vineyard, offering a perfect blend of quality wines and a rich, immersive experience.

The Surge in Promoter Stake Sales Raises Concerns

The surge in stake sales coincides with a notable increase in bulk and block trades in the secondary market. Despite a 10% dip in the number of issuances, these trades are at a record high, indicating a shift in ownership and significant realignment of portfolios. Siddhartha Bhaiya, MD and CEO of Aequitas Investment Consultancy Pvt., expressed concern about the frequency of Qualified Institutional Placements (QIPs) and block deals happening post substantial stock appreciation, describing the situation as “scary” for the broader markets.

Navigating Stormy Waters: Infosys Faces Contract Loss Amidst Economic Uncertainty

As Infosys and its stakeholders brace for the impact of these challenges, the company’s ability to adapt and innovate will be put to the test. Navigating stormy waters requires a strategic approach, resilient leadership, and a commitment to addressing the underlying issues. The IT giant will need to reassess its strategies, reinforce its competitive edge, and demonstrate agility in adapting to the evolving landscape.

Navigating the Future of Finance: Embracing Generative AI in Investment Strategies

Embark on a journey through the evolving landscape of finance with our exploration of Generative AI in investment strategies. This blog offers insights into the power and perils of incorporating AI in financial decision-making, drawing parallels with historical pitfalls. Delve into contrasting scenarios for AI adoption, challenges, and opportunities for investors, and the crucial role of proper interrogation in maximizing its potential. As the financial world embraces AI, discover the cautionary notes and nuanced perspectives that guide the next generation of investment professionals in navigating this transformative path

Embracing Simplicity: Unveiling the StocksEmoji Bot

In the fast-paced world of stock market updates and financial data, simplicity is often the key to staying ahead of the game. Meet the StocksEmoji bot – a revolutionary system designed to simplify your stock market interactions. With a playful twist, this innovative bot uses emoji characters to represent different stocks, making the complex world of finance more accessible and enjoyable. The Rise of StocksEmoji Bot: Navigate with Ease: Keeping up with stock market updates doesn’t have to be a daunting task. StocksEmoji bot introduces a fun and user-friendly way to stay informed. No need to sift through pages of complicated financial data; just interact with the bot using emojis! Emoji-Powered Analysis: The StocksEmoji bot utilizes the power of emojis to represent various stocks. Each emoji is a gateway to a wealth of real-time financial data. It’s like having a conversation with the market in a language

Unleashing Stock Box: Your Path to Adaptive Portfolio Evolution

In the world of investing, the principle of “Survival of the Fittest” is as timeless as Charles Darwin’s evolutionary theory. Just as in nature, where only the fittest endure, crafting a robust stock portfolio demands adaptability and constant evaluation. Portfolio reshuffling is akin to natural selection, where stocks that fail to meet expectations are eliminated. Recognizing the challenges investors face in this dynamic environment, StocksEmoji introduces a game-changing feature—Stock Box. The Darwinian Approach to Portfolio Building: Adaptability in Portfolio Building: Following Darwin’s logic, a researcher must adopt a strategy of building a portfolio that adapts to changing market conditions. The process of portfolio shuffling involves eliminating stocks that no longer align with expectations, making room for more promising opportunities. Constant Research and Rebalancing: Portfolio rebalancing is an ongoing task that demands constant research and attentiveness to changing market conditions. However, this process can be time-consuming and challenging.

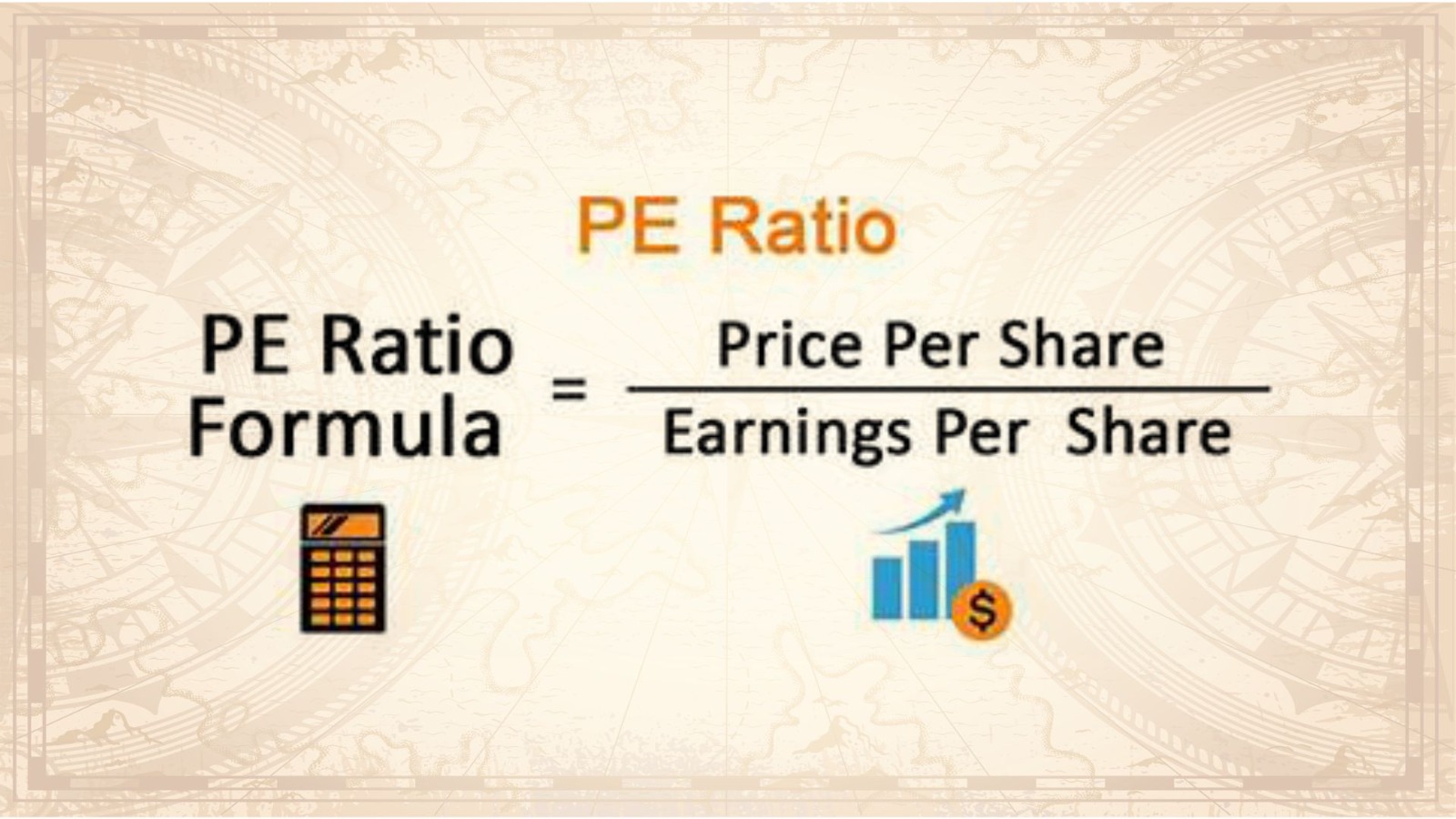

Unlocking Investment Insights: Demystifying the P/E Ratio

In the realm of investment analysis, few metrics hold as much significance as the Price-to-Earnings (P/E) Ratio. This fundamental tool provides a window into a company’s valuation, aiding investors in making informed decisions. Let’s unravel the intricacies of the P/E Ratio and explore why it stands as a beacon for savvy investors. Decoding the P/E Ratio Defining the Metric: The P/E Ratio is a financial metric calculated by dividing a company’s current stock price by its earnings per share (EPS) over the past 12 months. This ratio is a cornerstone of fundamental analysis, offering insights into how the market values a company relative to its earnings. Formula: P/E Ratio = Market Price per Share Earnings per Share (EPS) P/E Ratio= Earnings per Share (EPS) Market Price per Share The Significance Valuation Benchmark: High P/E: A high P/E Ratio may indicate that investors have high

The Telecommunications Bill, 2023: Navigating National Security and Telecom Sector Reforms

Explore the transformative landscape of India’s telecom sector with the recently approved Telecommunications Bill, 2023. This legislative milestone addresses national security concerns and introduces substantial reforms, empowering the government to temporarily control telecom services during emergencies. Delve into structural reforms, spectrum allocation methods, penalty reductions, and enhanced security measures.

Tata Motors Embarks on Share Restructuring Journey: DVRs to Ordinary Shares Conversion

Diving into the financial evolution of Tata Motors Ltd., this blog explores the recent strategic move of converting its DVR shares to ordinary shares. With no-objection certificates from NSE and BSE, the company’s scheme of arrangement aims at canceling DVRs and issuing ordinary shares, signaling a shift in its capital structure. Delve into the history of DVRs, the impact on promoter holdings, and the multifaceted benefits of this share capital reorganization.

Stock Help: Your Ultimate Health Card for Wealthy Stocks

Ralph Waldo Emerson once famously said, “Health is Wealth,” and this philosophy resonates not only in our personal lives but also in the dynamic world of stock markets. In the realm of investments, picking a healthy stock is synonymous with picking a wealthy stock. The health of a stock is determined by its financial background and statistics, akin to a health card for individuals. Recognizing the challenges investors face in deciphering the health of a stock, StocksEmoji.com introduces a revolutionary product—Stock Help. Decoding the Health of Stocks: The annual report of a company is its health card—a comprehensive document revealing the financial health and statistics of a stock. However, reading and interpreting an entire annual report can be time-consuming and challenging. This is where Stock Help steps in to simplify the process and provide investors with a robust health assessment of the stocks in their portfolio. Stock Help: Your Stock

Stock Help Analysis: Your Ultimate Health Card for Wealthy Stocks

Ralph Waldo Emerson once famously said, “Health is Wealth,” and this philosophy resonates not only in our personal lives but also in the dynamic world

Stock Emoji Analyser for Stock Analysis

Stock Emoji Analyser for Stock Analysis Embarking on the journey of investing is akin to embarking on a treasure hunt. The goal? Uncover a stock

Unveiling StocksEmoji: Simplifying Stock Market Investing for Everyone

“StocksEmoji is revolutionizing stock market investing by making it accessible to everyone. With simple emoji analysis, comprehensive data, and user-friendly tools, we empower investors to make informed decisions with ease. Whether you’re a beginner or an experienced investor, our platform offers unbiased guidance, visual data simplification, and expert insights to help you navigate market trends confidently.”

Tata Consumer’s Grocery Grab: Analyzing the Capital Foods & Organic India Acquisitions

Tata Consumer Products Ltd. (TCPL), the Indian FMCG giant behind Tetley tea and Himalayan water, made headlines with its recent acquisitions of Capital Foods and Organic India. But were these wise moves, or simply supermarket impulse buys? Let’s delve into the numbers and analyze the potential impact of these deals.

Japan’s Nikkei 225 Hits Three-Decade High

In a remarkable turn of events, Japan’s Nikkei 225 Stock Average has reached heights unseen since the nation’s bubble economy era over three decades ago. Closing at 33,763.18 in Tokyo, the blue-chip gauge surged 1.2%, marking its highest level since March 1990. This resurgence reflects growing investor optimism as Japan emerges from its prolonged battle with deflation, signalling a positive outlook for the country’s economic growth.

Electrifying the Roads: Nishant Arya’s Vision for a 100% Electric bus future by 2030

In recent years, the automotive industry has witnessed a paradigm shift towards sustainable and eco-friendly solutions, driven by a global commitment to reduce carbon emissions. One company at the forefront of this transformation is JBM Auto Ltd, a key player in the Indian automotive sector.

Unveiling Atmanirbhar Bharat Abhiyan: A Revolutionary Roadmap for Self-Reliant India 🚀

In a world of constant change, India has charted a course towards self-reliance with the Atmanirbhar Bharat Abhiyan. This transformative initiative is not just a policy but a journey that touches every aspect of our lives. Let’s dive into the heart of it!

Catalysts of change: Decoding India’s Economic Landscape for Investors

As India charts its course toward economic prosperity, driven by a resurgent capex cycle, robust banking sector, and strategic shifts in global supply chains, the nation is poised for sustained growth in 2024. Investors and businesses alike have a myriad of opportunities to explore in this dynamic landscape, solidifying India’s position as a key player in the global economic resurgence.

SOBHA Ltd: Building a Future of Growth and Resilience

In the dynamic landscape of the real estate sector, SOBHA Ltd. has been an intriguing player, experiencing a transformative journey over the recent years. As we delve into the company’s performance, strategies, and challenges, a compelling narrative of growth and resilience unfolds.

Insights from RBI’s Financial Stability Report

In its latest Financial Stability Report (FSR), the Reserve Bank of India (RBI) sheds light on the rapid expansion of the retail credit segment, raising concerns about the pro cyclicality of lending and heightened debt servicing costs. While there are no immediate signs of stress, the report emphasizes the need for vigilance, especially given the impressive compound annual growth rate (CAGR) of 25.5% in retail loans between September 2021 and September 2023.